The Danish parliament has now passed the bill that implements parts of the new political agreement concerning climate. It not only rewards companies that use electricity to generate heat in rooms, but the previous distinction between electricity used for process purposes and for heating and comfort cooling, will for most companies lapse from January 2021.

The distinction has meant that in 2020 the companies have received a smaller reimbursement of DKK 0.206 per kWh for electricity used for heating and comfort cooling, than for electricity for process purposes. The drop-out therefore gives the companies a financial gain of just over DKK 20.000 for every 100.000 kWh used for heating in rooms, comfort cooling and electric water heaters, etc.

Liberal businesses (e.g. lawyers, auditors, bureaus, etc.) will for a further two years only receive reimbursement of electricity tax regarding electricity for heating and comfort cooling etc. Only from 1 January 2023 will they be equated with other companies on this point.

New rates

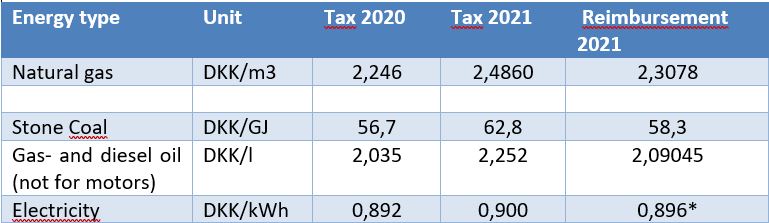

Please find the new rate of the energy types that most frequently are used as follows:

*For liberal businesses, the reimbursement for electricity - as mentioned above - only applies to the electricity used for heat in rooms as well as for heating domestic hot water and for comfort cooling. That is, not for electricity used for computers, machines, etc.

Special rules apply to reimbursement for companies within agriculture and for companies with special forms of production.

The content of the political agreement on a green tax reform will not have an impact on the energy tax costs in 2021, which still are placed on a level of 4,5 DKK/GJ.

Charging electric cars

According to the political agreement on green conversion of road transport, the special scheme for reimbursement to companies of electricity tax on electricity used for charging electric cars will be extended further to the end of 2030. The scheme means that companies in certain situations will be reimbursed 99.5 % of the tax paid if e.g. the energy consumption for the charging is measured separately.

The above article is taken from tax:watch, our electronic English newsletter on Danish Tax and VAT matters. tax:watch is issued on the last Friday of each month and is free of charge. Please sign up here.

Subscribe to receive the latest BDO News and Insights

Please fill out the following form to access the download.